The football season is over in the major European leagues, and while a select few clubs are participating in the Club World Cup, others are shaping their transfer strategies ahead of the new campaign. In February, we published a report on the market values of domestic football leagues worldwide. Now, with the 2024/25 season concluded, Sportingpedia follows it up by analysing the updated end-of-season data. The ranking covers the 25 most valuable domestic leagues in Europe, alongside the top 5 from Asia & Oceania, 5 from North and South America, and 3 from Africa.

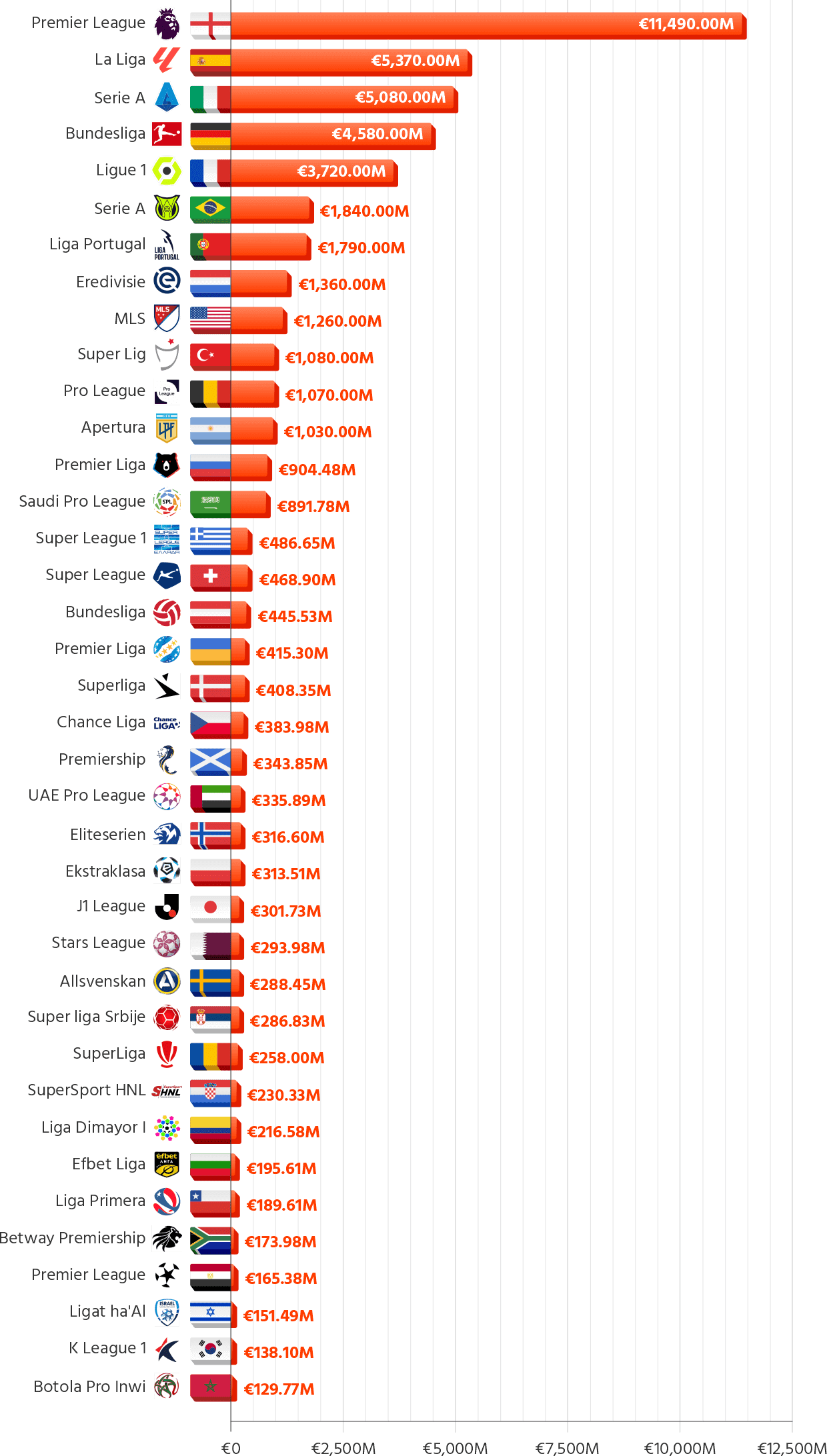

The latest data reveals that 12 leagues now surpass the €1 billion mark in total market valuation — up from 11 in February. The combined value of these leagues exceeds €39,6B. Belgium’s Pro League and Argentina’s Apertura have entered the so-called ‘billion club’, while the Saudi Pro League drops out after its value fell from €1.02 billion to €891.78 million. The findings reaffirm the Premier League’s status as football’s financial powerhouse, maintaining a clear lead over its European rivals despite a slight decrease in value since February.

Top domestic football leagues by combined team value (million €)

Data Source: Transfermarkt

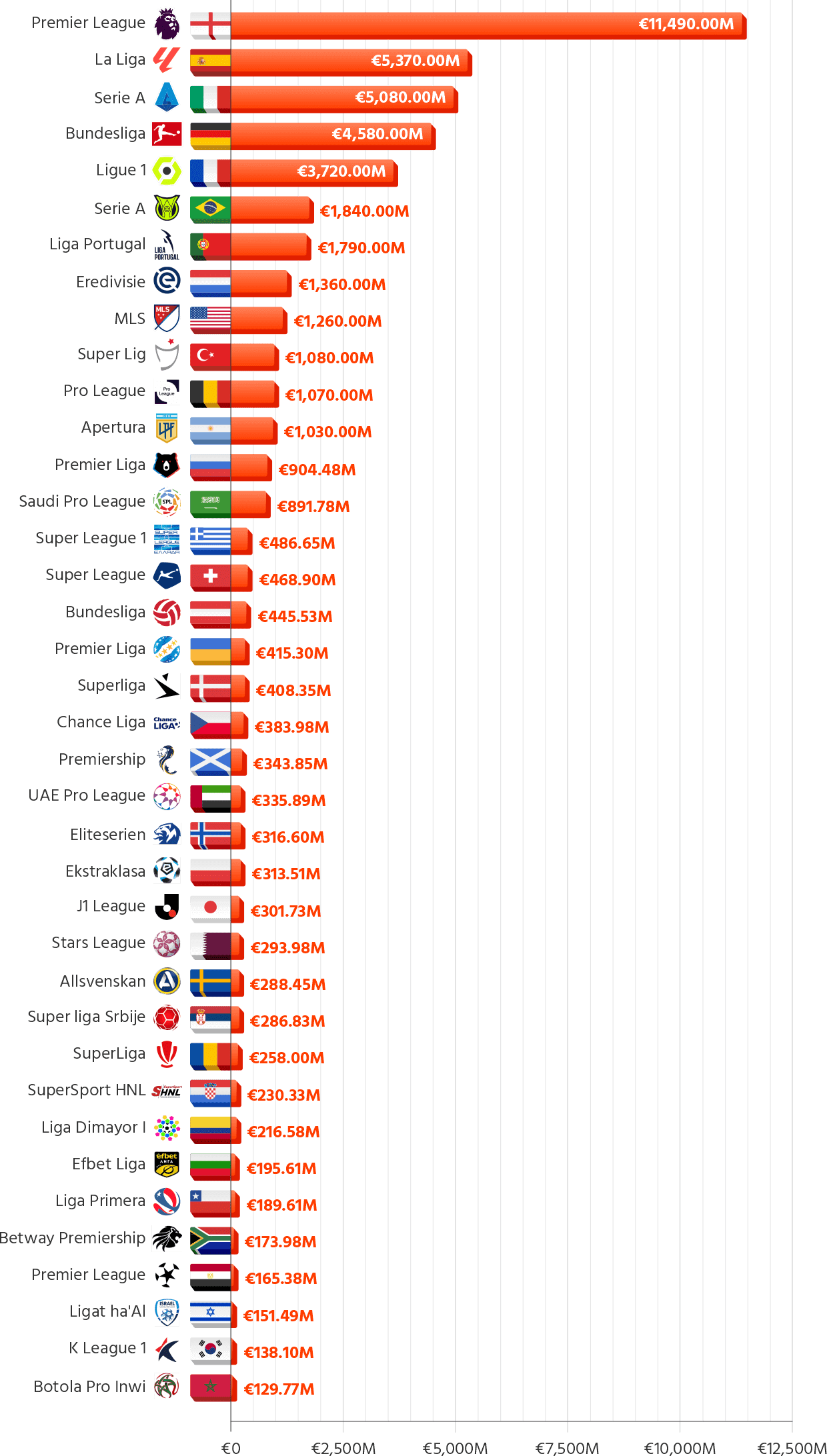

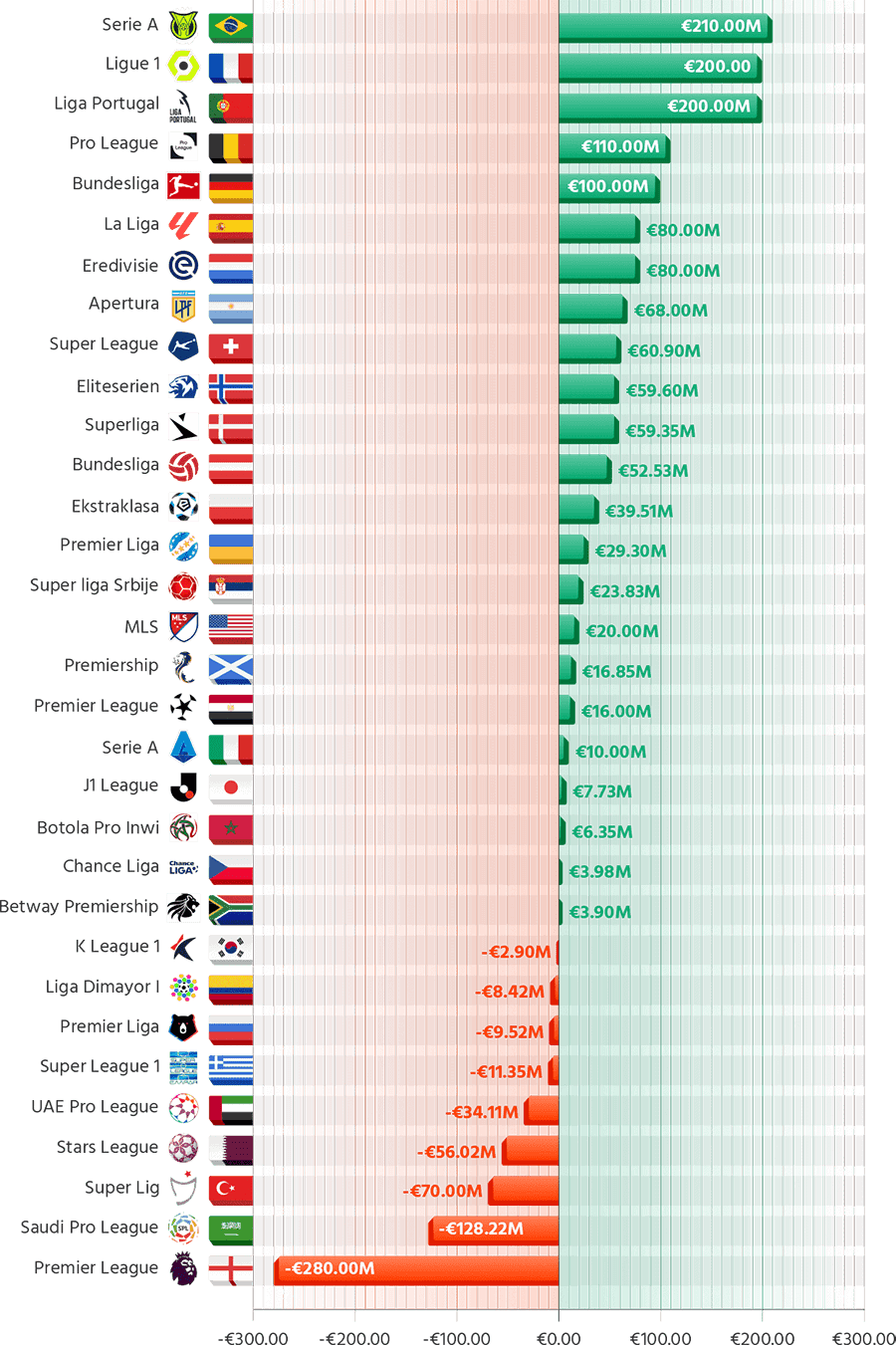

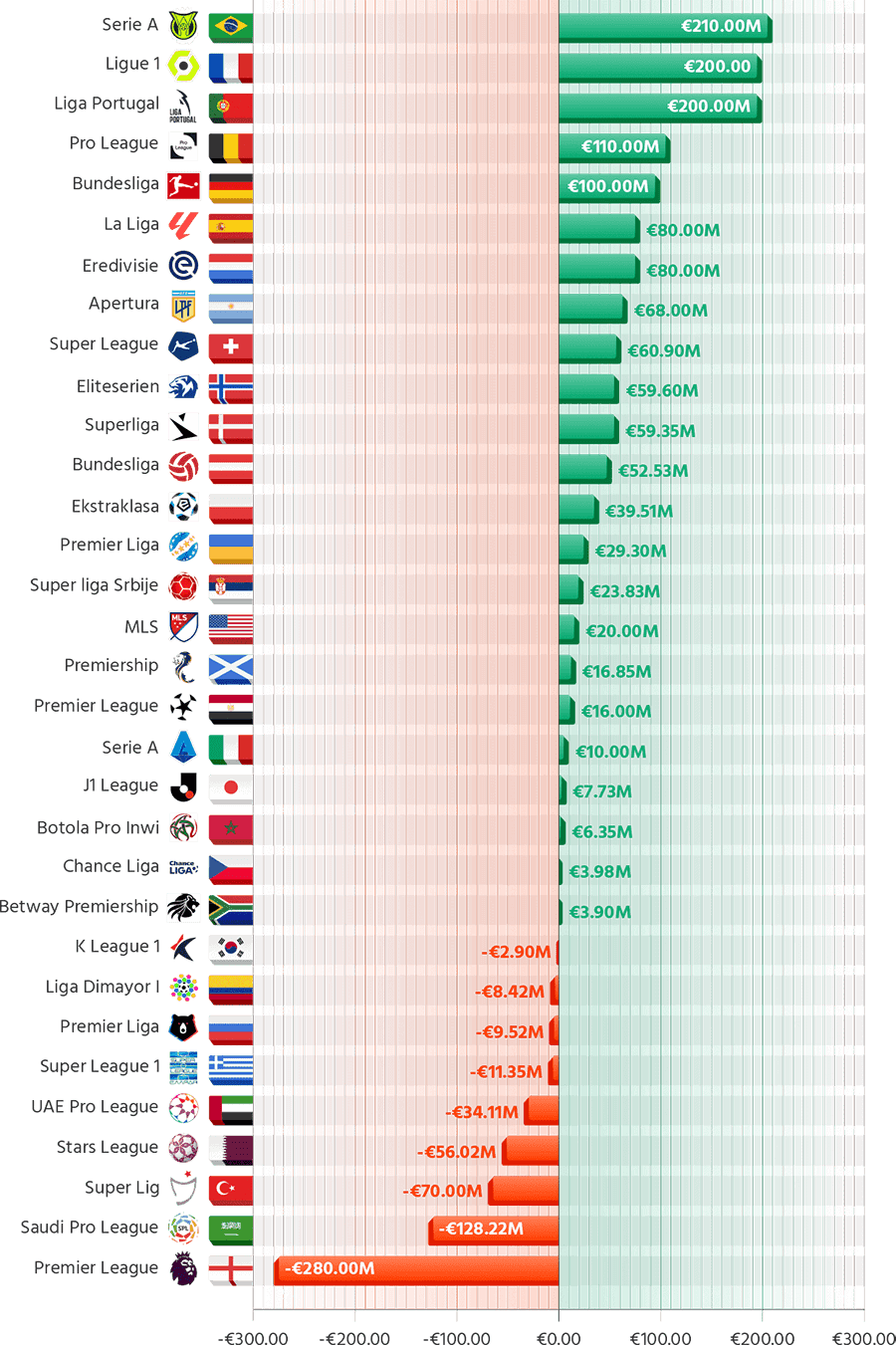

There have been no changes in the rankings for the 9 most valuable leagues since February. The English Premier League remains at the top with an estimate of €11,490 million, marking a slight drop of €280 million compared to 4 months ago. Turkiye’s Super Lig is the only other league in this group to lose value, falling from €1,150 million to €1,080 million. In contrast, Brazil’s Serie A recorded the biggest increase with a rise of €210 million, just ahead of Ligue 1 and Liga Portugal, both up by €200 million. Germany’s Bundesliga gained €100 million, while La Liga and the Eredivisie each rose by €80 million, and the MLS also saw a modest boost of €20 million.

While the elite positions remain unchanged, the most notable movements occurred just below the top 10. Belgium’s Pro League surged by €110 million, while Argentina’s Apertura climbed €68 million, with both now surpassing the symbolic €1 billion mark for the first time. Their rise means the number of billion-euro leagues has grown from 11 in February to 12 in June, despite the exit of Saudi Arabia’s Pro League, which dropped sharply by €128.22 million, now valued at €891.78 million.

Other strong performers include Switzerland’s Super League (+€60.90M), Denmark’s Superliga (+€59.35M), Norway’s Eliteserien (+€59.60M), and Austria’s Bundesliga (+€52.53M). Ukraine’s Premier Liga gained €29.30 million, while Serbia’s Super Liga added €23.83 million. Moderate increases were also seen in Poland’s Ekstraklasa (+€39.51M), Scotland’s Premiership (+€16.85M), Egypt’s Premier League (+€16M), Japan’s J1 League (+€7.73M), and Morocco’s Botola Pro Inwi (+€6.35M). Czech Republic’s Chance Liga and South Africa’s Betway Premiership posted smaller but still positive gains of €3.98M and €3.90M, respectively.

On the decline side, Qatar’s Stars League suffered a notable reduction of €56.02 million, and UAE’s Pro League fell by €34.11 million. Greece’s Super League 1 (–€11.35M), Russia’s Premier Liga (–€9.52M), Colombia’s Liga Dimayor I (–€8.42M), and South Korea’s K League 1 (–€2.90M) also experienced downward adjustments.

Change in value for the top domestic football leagues since February

Data Source: Transfermarkt

While the top 10 remains completely unchanged in terms of ranking, with the Premier League, La Liga, Serie A, Bundesliga, Ligue 1, and others maintaining their positions, notable shifts have occurred further down the table.

The biggest climber since February has been Norway’s Eliteserien, which jumped 5 places in the global standings. Denmark’s Superliga and Scotland’s Premiership also posted strong gains, each rising by 4 and 3 positions respectively. Czech Republic’s Chance Liga gained 3 spots, while Belgium’s Pro League and Poland’s Ekstraklasa moved up 2 places each.

Russia, Greece, Switzerland, Austria, and Ukraine all moved up 1 place in the rankings, reflecting minor but steady improvements in market valuation.

At the other end of the spectrum, South Korea’s K League 1 experienced the steepest fall, dropping 5 positions, followed closely by Qatar’s Stars League, South Africa’s Betway Premiership, and Egypt’s Premier League, each of which dropped 4 places. The Saudi Pro League, despite being a key talking point over the past year, dropped 3 spots, reflecting a market correction following heavy investment cycles.

Other minor declines included Colombia’s Liga Dimayor I (–2), and single-position drops for UAE Pro League and Serbia’s Super Liga.