Transfer balance is one of the clearest ways to judge how clubs really operate in the market, because it shows who consistently pays for squad upgrades and who funds their model through sales. Sportingpedia analysed the top 10 clubs worldwide for net spending and net income across two timeframes – the last two transfer windows (the current 2025/26 season) and the last 10 windows (the last five seasons) – using each club’s reported transfer income and expenditure to calculate net balance. One of the report’s most curious revelations is how sharply the market splits across both timeframes: Arsenal lead the current-season net spending table at €362 million, while Monaco top the current-season net income ranking at €149 million. Over the last five seasons, Chelsea sit as the biggest net spenders at €883 million, while Benfica lead the net income table at €346 million. Over the longer horizon, Liga Portugal and the Eredivisie both stand out as the strongest seller leagues, placing three clubs each in the long-term top 10 through Benfica, Porto, and Sporting for Portugal and Ajax, PSV, and AZ for the Netherlands.

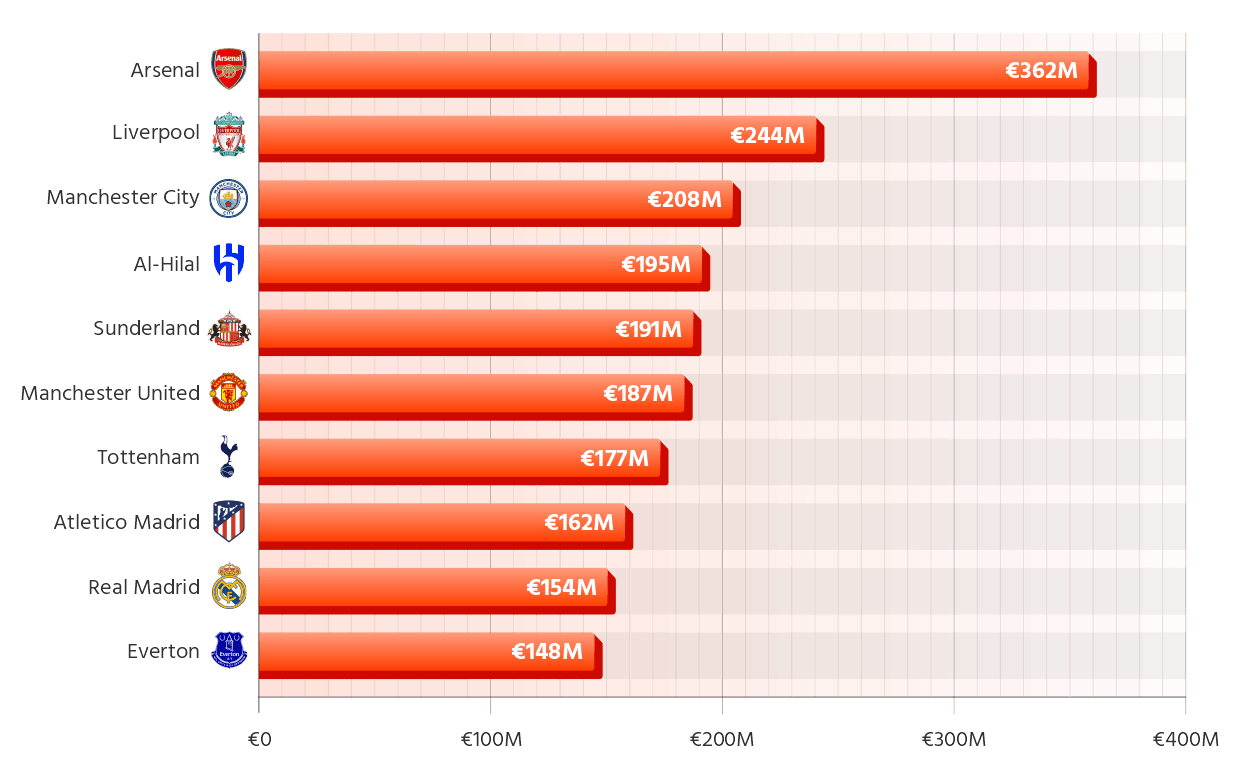

Clubs with the Highest Net Spending for the 2025/26 Season

Data Source: Football-observatory.com

The current-season ranking is dominated by England. Seven Premier League sides appear in the top 10, and together they account for nearly three quarters of the net outlay in the entire table. Across all 10 clubs, total expenditure reaches €2,845 million against €817 million in income, producing a combined net spend of €2,028 million.

Arsenal’s position at number one is built on an unusually low sales offset. With €378 million spent and only €16 million recouped, their €362 million balance is the most extreme in the dataset and establishes a clear gap to the rest of the list. Liverpool rank second at €244 million, but their profile is structurally different: they generate €255 million in income, the highest in the top 10, yet still sit deep in the red because their expenditure rises to €499 million, also the largest spend in the table. That combination makes them the clearest example here of a club buying aggressively while still completing substantial outgoing business.

Manchester City follow at €208 million, driven by €336 million of expenditure against €128 million of income. Beneath the Premier League trio, Al-Hilal are the only Saudi Pro League entry, posting a €195 million net spend after €207 million in expenditure and €12 million in income, placing them alongside England’s biggest operators in the current-window market.

Sunderland’s presence at €191 million is one of the more striking inclusions in the top 10, with €243 million spent against €52 million earned. Manchester United (€187 million) and Tottenham (€177 million) sit in the same band, each combining sizeable outlay with relatively modest sales returns (United: €280 million spent, €93 million earned; Tottenham: €250 million spent, €73 million earned). Everton complete the Premier League group at €148 million after spending €158 million and bringing in €10 million.

Spain contributes two clubs, both in the upper half of the table. Atletico Madrid record €162 million despite a strong €144 million in income, because their expenditure rises to €306 million. Real Madrid sit just behind at €154 million, with €188 million spent and €34 million earned. While La Liga’s representation is smaller than the Premier League’s, both Spanish clubs are operating at levels that still place them among the top net buyers worldwide across the current two-window span.

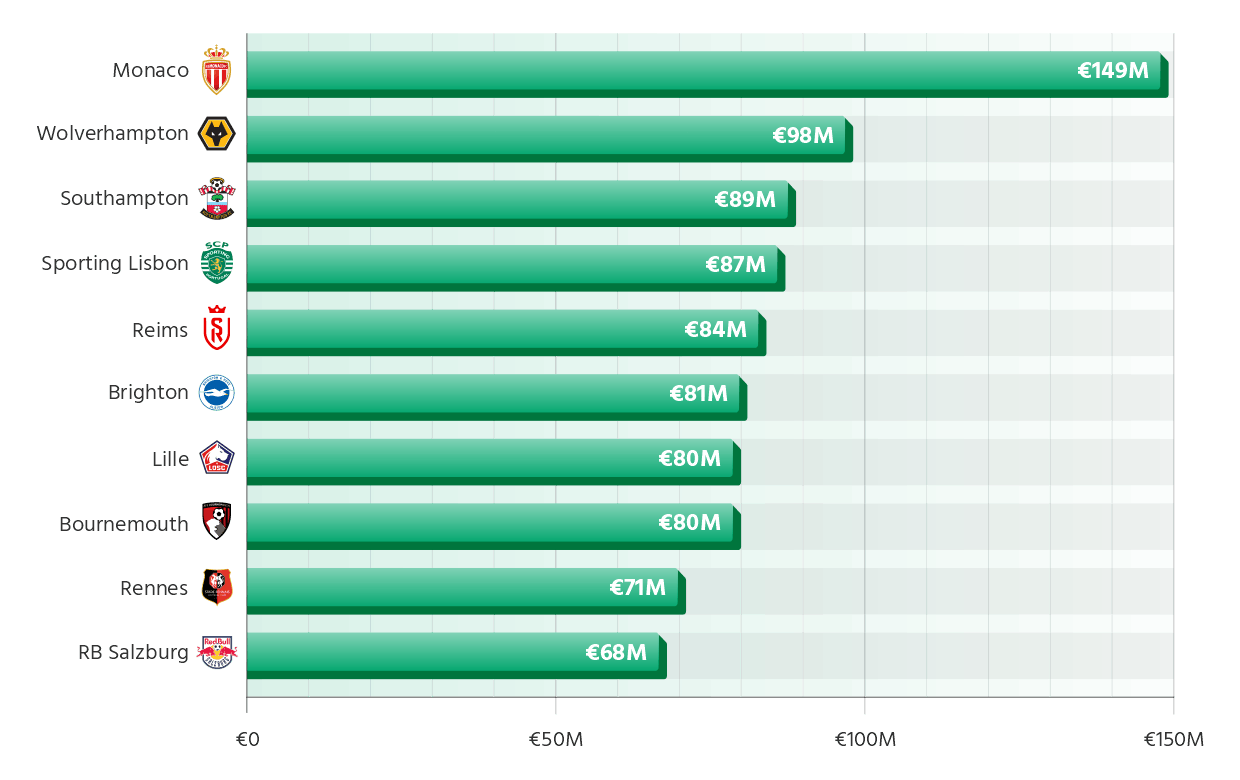

Clubs with the Highest Net Income for the 2025/26 Season

Data Source: Football-observatory.com

This ranking is led by Monaco (Ligue 1), who post the strongest positive balance at €149 million after generating €168 million in income and spending just €19 million. Wolverhampton (Premier League) rank second on €98 million (€240 million income, €142 million expenditure), followed by Southampton (Championship) on €89 million and Sporting Lisbon (Liga Portugal) on €87 million.

The middle of the table is packed with Ligue 1 and Premier League clubs operating as net sellers despite still spending. Reims sit on €84 million after spending just €4 million, Brighton post €81 million, while Lille and Bournemouth both land on €80 million. Bournemouth’s position is shaped by the highest income in the entire top 10 at €293 million, even though they also spend heavily at €213 million. Rennes (€71 million) and Salzburg (€68 million) complete the group, keeping the seller list tilted towards leagues that regularly trade players out at peak value.

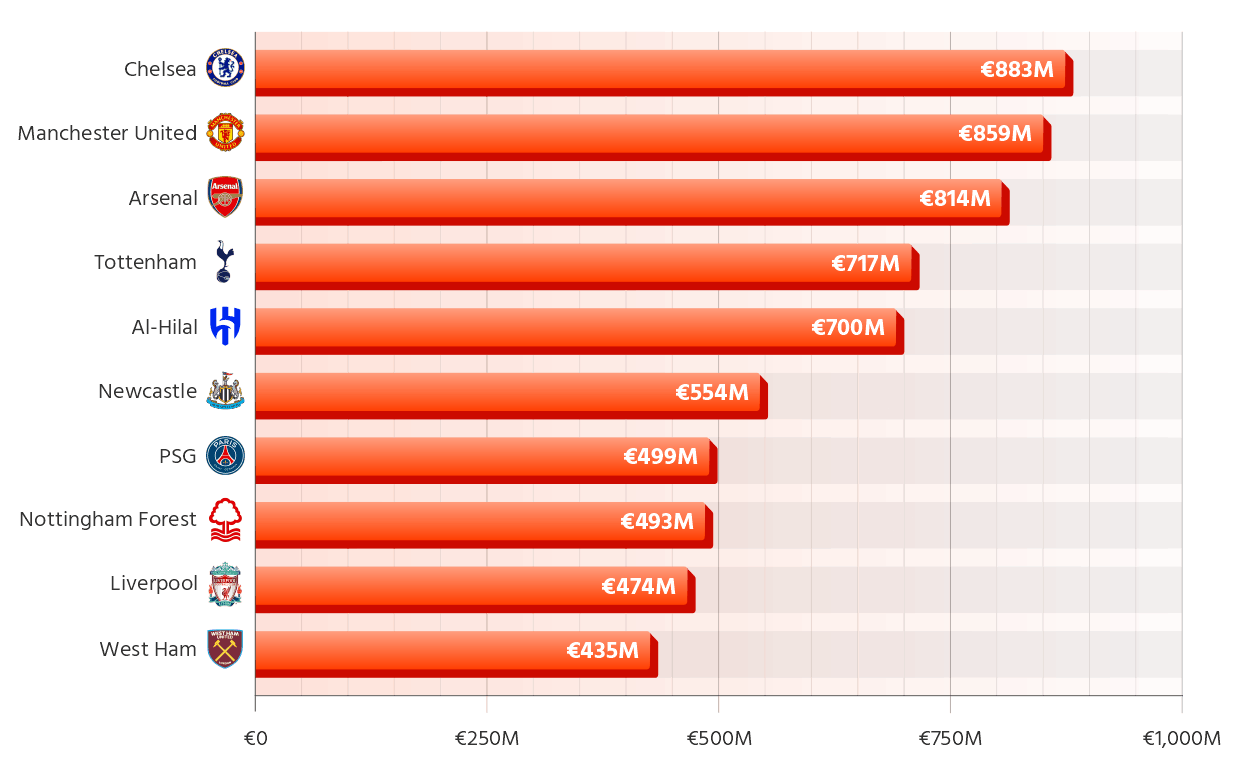

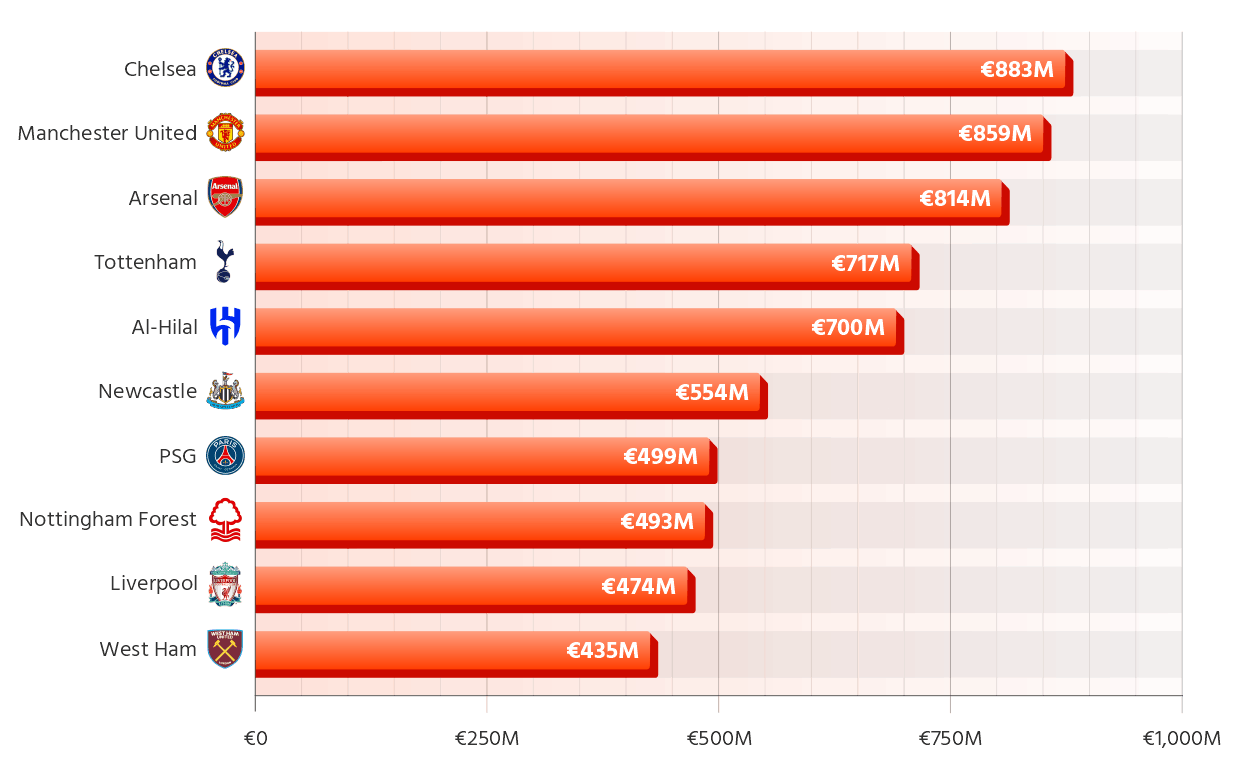

Clubs with the Highest Net Spending for the Last 5 Seasons

Data Source: Football-observatory.com

Over a five-year horizon, the net spending table is even more Premier League-heavy than the current-season view. Eight of the top 10 clubs are from England, and across the full group the combined figures reach €10,985 million in expenditure against €4,557 million in income, producing a total net spend of €6,428 million.

Chelsea top the ranking on €883 million after €2,057 million in spending and €1,174 million in income, narrowly ahead of Manchester United (€859 million) and Arsenal (€814 million). Tottenham follow on €717 million, creating a clear Premier League cluster at the top of the table.

The only non-English club outside Europe’s top five leagues is Al-Hilal, who post a €700 million balance (€731 million spent, €31 million earned), while PSG are Ligue 1’s sole entry at €499 million. Newcastle (€554 million), Nottingham Forest (€493 million), Liverpool (€474 million) and West Ham (€435 million) complete an England-dominated top 10, underlining how sustained net buying over multiple windows remains concentrated in a small set of Premier League clubs.

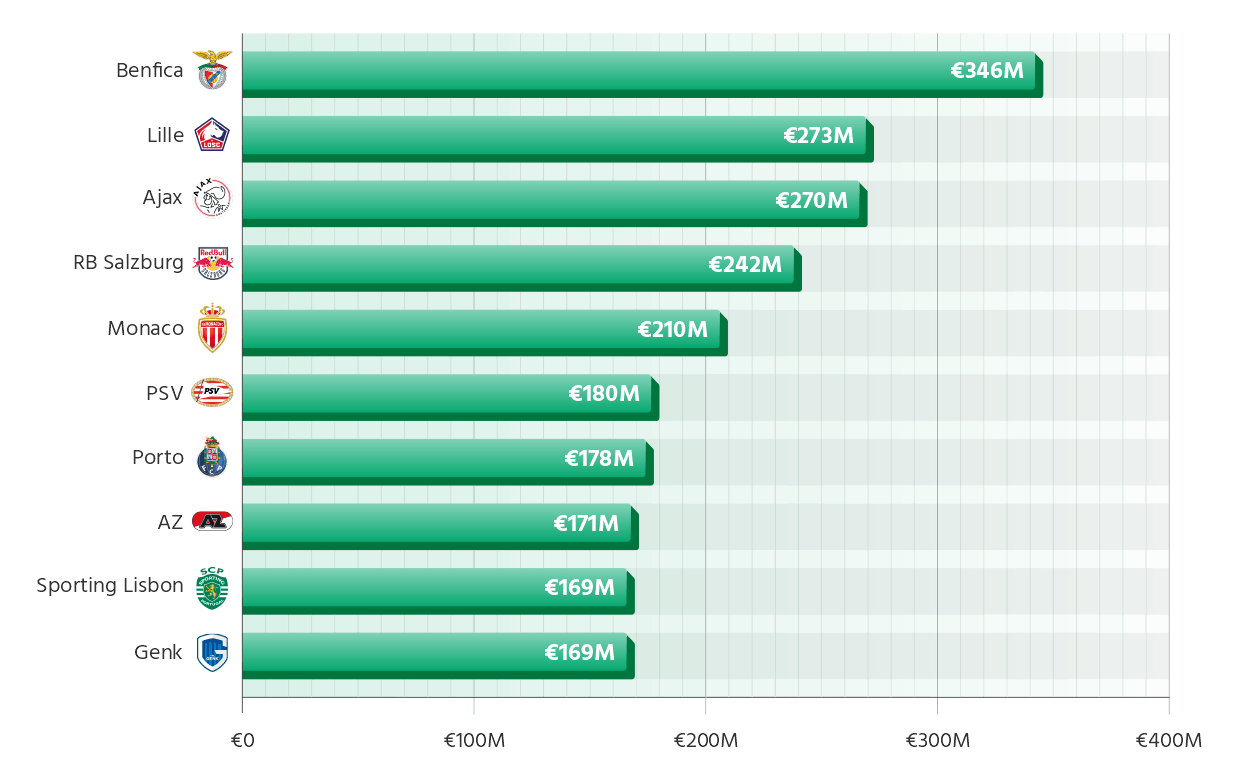

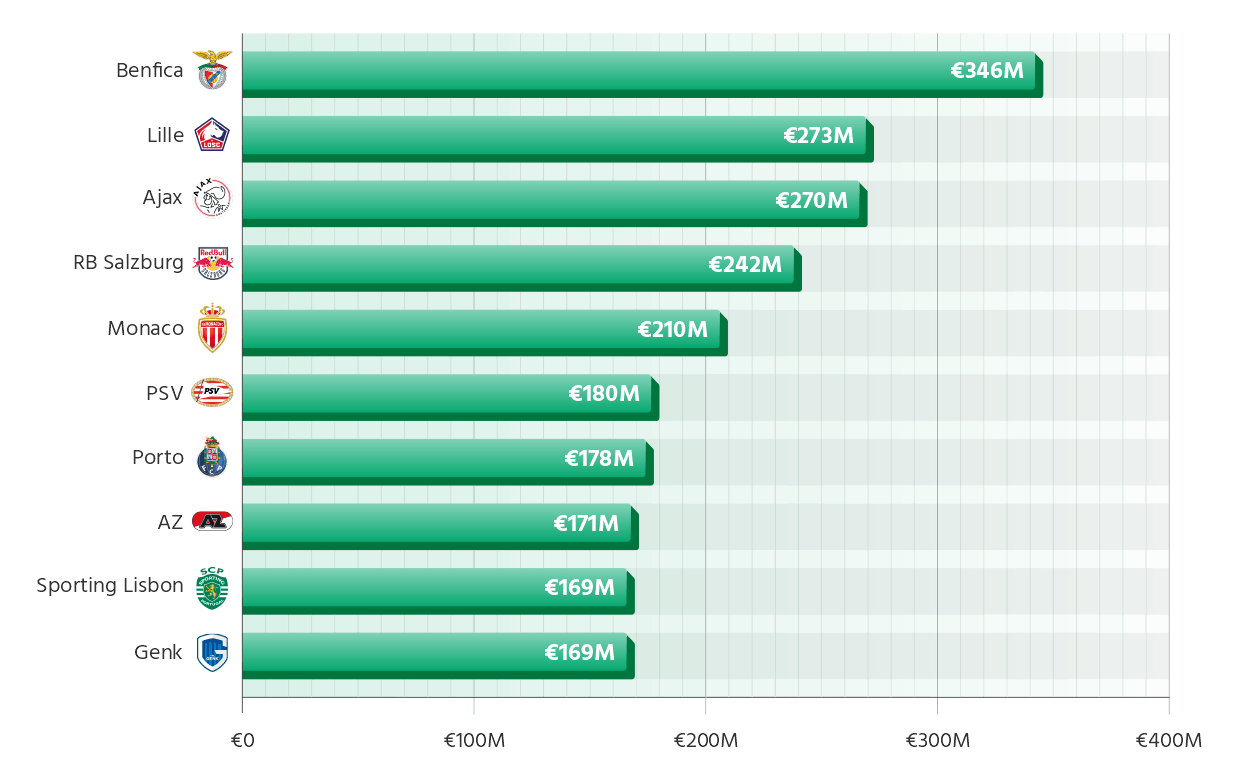

Clubs with the Highest Net Income for the Last 5 Seasons

Data Source: Football-observatory.com

This table is led by Benfica (Liga Portugal), who post the strongest net income at €346 million after generating €811 million in transfer income against €465 million in expenditure. The rest of the top three is split between France and the Netherlands, with Lille (Ligue 1) on €273 million (€447 million income, €174 million expenditure) and Ajax (Eredivisie) on €270 million (€636 million income, €366 million expenditure), while RB Salzburg (Austrian Bundesliga) follow closely at €242 million.

Monaco (Ligue 1) add another major seller profile at €210 million, while the Dutch pipeline dominates the middle of the table through PSV (€180 million) and AZ (€171 million), alongside Ajax. Portugal also place three clubs in the top 10, with Porto on €178 million and Sporting Lisbon on €169 million joining Benfica at the top, while Genk (Belgian League) match Sporting on €169 million to complete the group.

From This Season to the Past Five Seasons: Structural Picture

The four rankings make the short-term and long-term transfer market look like two different ecosystems. Over the last two windows, the net spending table is already heavily tilted towards the Premier League, with seven English clubs in the top 10 and Arsenal’s €362 million leading a group where even strong sales do not prevent major negative balances, as shown by Liverpool posting €244 million despite the highest income in that table (€255 million). Stretch the lens to the last 10 windows and the pattern hardens into sustained dominance: eight Premier League clubs make the five-year net spending top 10, led by Chelsea (€883 million), Manchester United (€859 million), Arsenal (€814 million) and Tottenham (€717 million), turning what looks like a single-window splurge into a long-running structural trend.

On the seller side, the shift is even clearer. The current-season net income top 10 is shaped by Ligue 1, which places four clubs (Monaco, Reims, Lille and Rennes), with Monaco’s €149 million leading the table. But the longer-term picture is driven less by France and more by the leagues built around sustained trading models: Liga Portugal and the Eredivisie dominate the last 10 windows net income ranking with three clubs each. Benfica top the five-year seller table at €346 million, while Porto (€178 million) and Sporting Lisbon (€169 million) reinforce Portugal’s repeat presence, matched by Ajax (€270 million), PSV (€180 million) and AZ (€171 million) for the Netherlands. The contrast is sharp: France produces many of the season’s biggest net sellers, but Portugal and the Netherlands are the leagues that keep placing clubs in the global top 10 over five full seasons.