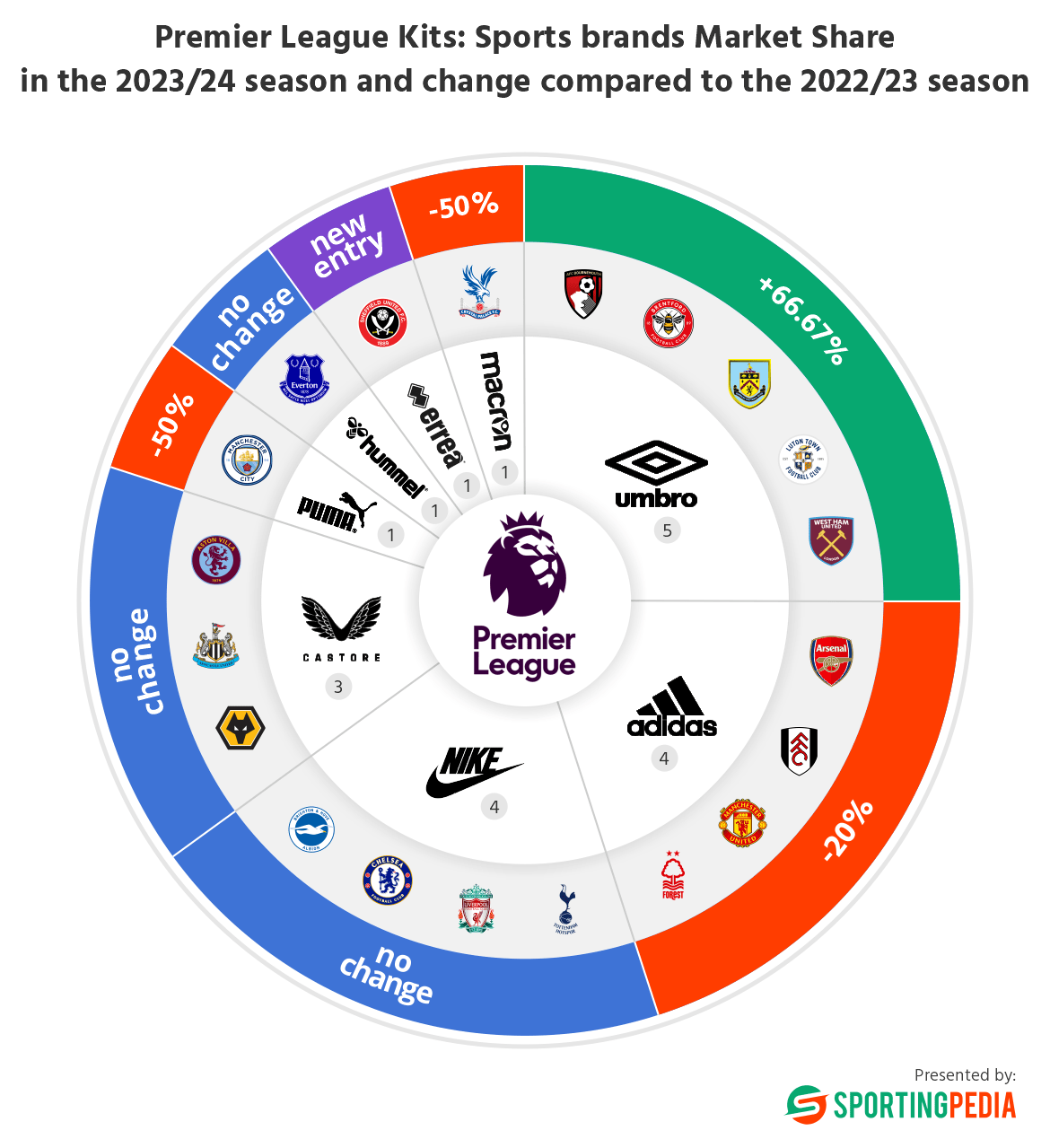

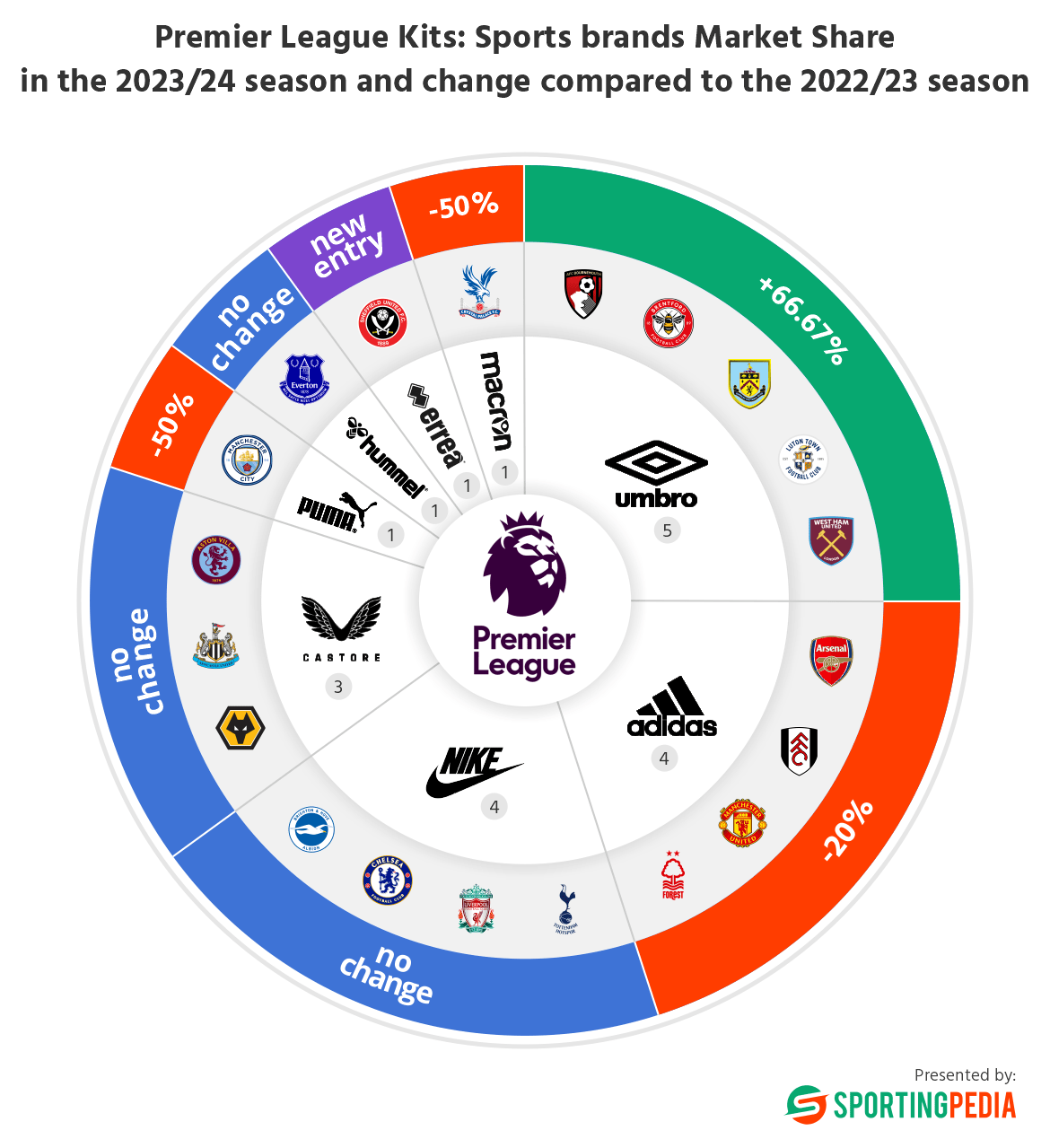

The Premier League’s 2023/24 season will not only be a battleground for football supremacy but also a showcase of sports brands competing for market share. Recently all Premier League kit suppliers for the 2023/2024 season became known and there is a major shift in the power balance of the kit makers in the first English echelon. The upcoming campaign will be the first in 13 years to see a company based in England as the Premier League’s leading kit supplier, namely Umbro.

This shift in balance prompted our team at Sportingpedia to have a more detailed look and comparison of the kit manufacturers market in the Premier League and its dynamics. We took the kit makers from the previous 22/23 and the upcoming 23/24 campaigns and calculated the change for every brand heading into the new season.

Umbro: A Time-Honored Legacy

The company’s roots date back to 1924 in Manchester, England. Umbro’s rich history in football is reflected in its kit supply deals for Bournemouth, Brentford, Burnley, Luton, and West Ham for the upcoming season. The brand’s classic designs continue to resonate with both fans and players, solidifying its market share in the Premier League.

Nike: Swooshing in Style

Founded in 1964 in Beaverton, Oregon, USA, Nike has become a global sportswear giant. In the 2023/24 season, Brighton, Chelsea, Liverpool, and Tottenham will don the iconic Swoosh, showcasing Nike’s dominance as a top-tier sports brand in the Premier League.

Adidas: The Three Stripes Tradition

Originating in Herzogenaurach, Germany in 1949, Adidas boasts a legacy of outfitting footballing powerhouses. Next season, Arsenal, Fulham, Manchester United, and Nottingham will display the Three Stripes, reinforcing Adidas’ substantial market share in the league.

Castore: Ambitious Ascent

Founded in 2015 in Liverpool, England, Castore may be a young contender, but it has quickly made a mark in the football kit market. In 2023/24, Aston Villa, Newcastle, and Wolverhampton will don Castore’s designs, signaling the brand’s ambitious growth and presence in the Premier League.

Puma: Roaring in Manchester

Puma, founded in 1948 in Herzogenaurach, Germany, has its presence felt through Manchester City. The German company enjoyed the publicity last season, as City went on to win a famous treble. Puma also hit the jackpot when one of the most recognizable names in modern football – Erling Haaland decided to join the Sky-blues last summer. This in no small part helped to generate additional interest towards Puma’s products.

Macron: Italian Flair at Crystal Palace

Originating in Crespellano, Italy in 1971, Macron brings a touch of Italian flair to Crystal Palace’s kits for the 2023/24 season. The brand’s unique designs add diversity to the Premier League’s kit landscape.

Errea: Sheffield United’s Partner

Founded in Parma, Italy in 1988, Errea’s sports brand presence in the Premier League is epitomized by Sheffield United’s kits for the upcoming season. The brand’s meticulous craftsmanship continues to impress.

Hummel: Everton’s Heritage

With a history dating back to 1923 in Aarhus, Denmark, Hummel’s heritage resonates in Everton’s kits for the 2023/24 season. Hummel’s distinctive chevrons add character to the Premier League apparel.

Comparison to previous seasons

In comparing the brands’ market share last season with the upcoming one, we see that some noteworthy shifts in the Premier League’s landscape have taken place. Umbro has experienced substantial growth, ascending from outfitting three clubs last season to an impressive five teams for the 2023/24 season. The increase solidifies Umbro’s position as a dominant player in the league’s sportswear market. Adidas saw a drop from five to four clubs, while there was no change for Nike, Castore and Puma. Errea entered the league with one partnership, contributing to the diversity of sports brands in the upcoming season.

The record for biggest market share across the past 10 seasons in the Premier League is held by Adidas. The German company had nine teams in the 2013/14 campaign, displaying an unparalleled dominance. However, nowadays, this number has declined by more than half, marking a shift in the sports brand market dynamics. Recent years saw Castore enter the scene, gaining ground with three teams.